Mitihoon – On September 24, 2024, Mr. Narongsak Jivakanun, Chief Executive Officer, Mr. Toasaporn Boonyapipat, President, and Ms. Pattaralada Sa-Ngasang, Executive Vice President – Finance and Accounting, PTT Global Chemical Public Company Limited (“GC”), together with executives from 12 leading financial institutions, participated in the ceremony appointing the arrangers for subordinated hybrid debentures issuance of PTT Global Chemical Public Company Limited.

Mitihoon – On September 24, 2024, Mr. Narongsak Jivakanun, Chief Executive Officer, Mr. Toasaporn Boonyapipat, President, and Ms. Pattaralada Sa-Ngasang, Executive Vice President – Finance and Accounting, PTT Global Chemical Public Company Limited (“GC”), together with executives from 12 leading financial institutions, participated in the ceremony appointing the arrangers for subordinated hybrid debentures issuance of PTT Global Chemical Public Company Limited.Mr. Narongsak Jivakanun, CEO of GC, a global leader in the chemical business and as PTT Group’s chemical flagship operation, revealed that the Company is preparing to offer subordinated hybrid debentures, payable upon dissolution with the Issuer’s right to early redemption and unconditional interest deferral (“subordinated hybrid debentures”). The subordinated perpetual debentures will be offered to general public via the placement of Public Offering (PO), with the aim to strengthen GC’s financial structure, support business growth, and sustain the company’s future development.

Mr. Narongsak further stated this is the first time for GC to offer subordinated hybrid debentures, and the first time for subordinated hybrid debentures issuance by PTT Group in Thailand for decade. This issuance is a significant step of GC’s journey toward sustainable growth (#NextStepwithSustainableGrowth). We believe that the debentures offer a secure investment option with attractive returns for retail investors.

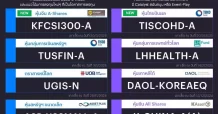

GC’s subordinated hybrid debentures allows GC to exercise a call option after the debentures reach its 5 years and 6 months anniversary. Interest will be paid every 6 months throughout the term. The final coupon rate and subscription period will be announced later. Retail investors can subscribe with a minimum amount of 100,000 Baht and in a multiple of 100,000 Baht, through 12 leading financial institutions, including Bangkok Bank, CIMB Thai Bank, KASIKORNBANK, Kiatnakin Phatra Securities, Krungthai Bank, Siam Commercial Bank, Asia Plus Securities, Bank of Ayudhya, Krungthai XSpring Securities, Maybank

Securities (Thailand), TMBThanachart Bank, and Yuanta Securities (Thailand). GC is confident that its subordinated hybrid debentures will offer an attractive investment option for investors due to the Company’s solid business fundamentals, financial strength, and its position as PTT Group’s chemical flagship operation. These factors are believed to help enhance investor confidence to invest in GC’s subordinated hybrid debentures.

In addition to GC’s subordinated hybrid debentures being an attractive investment option, investors also get to be a part of GC’s sustainability story. GC, as a market leader in sustainability, is the only company in the world ranked by

the Dow Jones Sustainability Indices (DJSI) in World Index as the number one company in the chemical sector for five consecutive years, with the highest scores awarded by S&P Global. This recognition underscores GC’s commitment to becoming a global sustainability leader by balancing Environmental (E), Social (S), and Governance and economic (G) (ESG) principles. The company focuses on driving sustainability throughout its entire business chain, with a clear goal of achieving net-zero greenhouse gas emissions by 2050. This target aligns with the objectives of the Paris Agreement, established under the United Nations

Framework Convention on Climate Change, to combat climate change.

Fitch Ratings (Thailand) has recently rated GC at “AA(tha)” with “Stable” outlook as of 20 September 2024. The outlook is lifted from “Negative” to “Stable” due to the Company’s commitment to its deleveraging plan. The subordinated hybrid debentures are rated “A+(tha)” as of 23 September 2024. As a true global petrochemical player, this issuance will mark as “The first subordinated perpetual debentures in Thailand to potentially obtain equity credit from all leading credit

rating agencies”. The rating agencies include Moody’s Investors Service, S&P Global Ratings and Fitch Ratings Inc, emphasizing GC’s global position and its international financial strength and presence. GC plans to use the proceeds from these subordinated hybrid debentures to repay its existing THB and USD denominated debts. The company has already submitted the initial information and draft prospectus to the Securities and Exchange Commission (SEC) of Thailand; and the SEC is in its reviewing process. Therefore, the prospectus has not yet become effective. Those who are interested can study further details and the terms and conditions in the draft prospectus and inquires more information at the followings 12 arrangers:

• Bangkok Bank Public Company Limited, at all branches (except micro branches) or call 1333, or subscribe online via Bangkok Bank Mobile Banking.

• CIMB Thai Bank Public Company Limited, at all branches, or call 02-626-7777.

• KASIKORNBANK Public Company Limited, at all branches, call 02-888-8888 press 869, and at KASIKORN Securities Public Company Limited as a sales agent of KASIKORNBANK Public Company Limited.

• Kiatnakin Phatra Securities Public Company Limited, call 02-165-5555, or subscribe online via Dime! app and at Kiatnakin Phatra Bank Public Company Limited as a sales agent of Kiatnakin Phatra Securities Public Company Limited.

• Krung Thai Bank Public Company Limited, at all branches, or call 02-111-1111, or subscribe online via Money Connect by Krungthai in Krungthai NEXT application.

• The Siam Commercial Bank Public Company Limited, at all branches, or call 02-777-6784, or subscribe online via the SCB EASY App, and at InnovestX Securities Co., Ltd., as a sales agent of the Siam Commercial Bank Public Company Limited.

• Asia Plus Securities Company Limited, call 02-680-4004.

• Bank of Ayudhya Public Company Limited, at all branches, or call 1572.

• Krungthai XSpring Securities Co., Ltd., call 02-695-5000.

• Maybank Securities (Thailand) Public Company Limited, call 02-658-5050.

• TMBThanachart Bank Public Company Limited, at all branches, or call 1428, press #4 (booking is open only to institutional investors), and at Thanachart Securities Public Company Limited as a sales agent of TMBThanachart Bank Public Company Limited.

• Yuanta Securities (Thailand) Co., Ltd., call 02-009-8351-56.

ติดตามช่องทางมิติหุ้นเพื่อรับข่าวสารตลาดทุนได้ตามลิงค์ด้านล่าง

Web : https://www.mitihoon.com/

Facebook : https://www.facebook.com/mitihoon

Youtube : https://www.youtube.com/@mitihoonofficial7770

Tiktok : www.tiktok.com/@mitihoon

.